Instant Payments

Solving Cash Flow Challenges for Gig Workers with Instant Payment Solutions

MY ROLE

Lead product designer

TIMELINE

September 2018 - January 2019

TEAM

1 Lead product designer

1 Content designer

1 UX researcher

1 Product manager

1 SWE team

Problem

Gig workers, including food delivery drivers, traditionally faced significant cash flow challenges due to weekly payment cycles. This model often left them struggling to meet immediate financial needs.

Product Vision

I saw an opportunity to transform Chase from a passive utility into an active partner for the gig economy. By integrating directly with Grubhub's data, we could eliminate the 'application fatigue' that caused 40% of applicants to drop off, turning a compliance-heavy banking process into a bite sized benefit.

Solution

With the rise of innovative payment solutions, there was an opportunity to transform how these workers access their earnings, ensuring they receive payments instantly when needed.

Eyebrow text to label this content

My Responsibilities

In this Chase - Grubhub partnership, my objective was to collaborate with the Grubhub team to accelerate payment processes for their drivers.

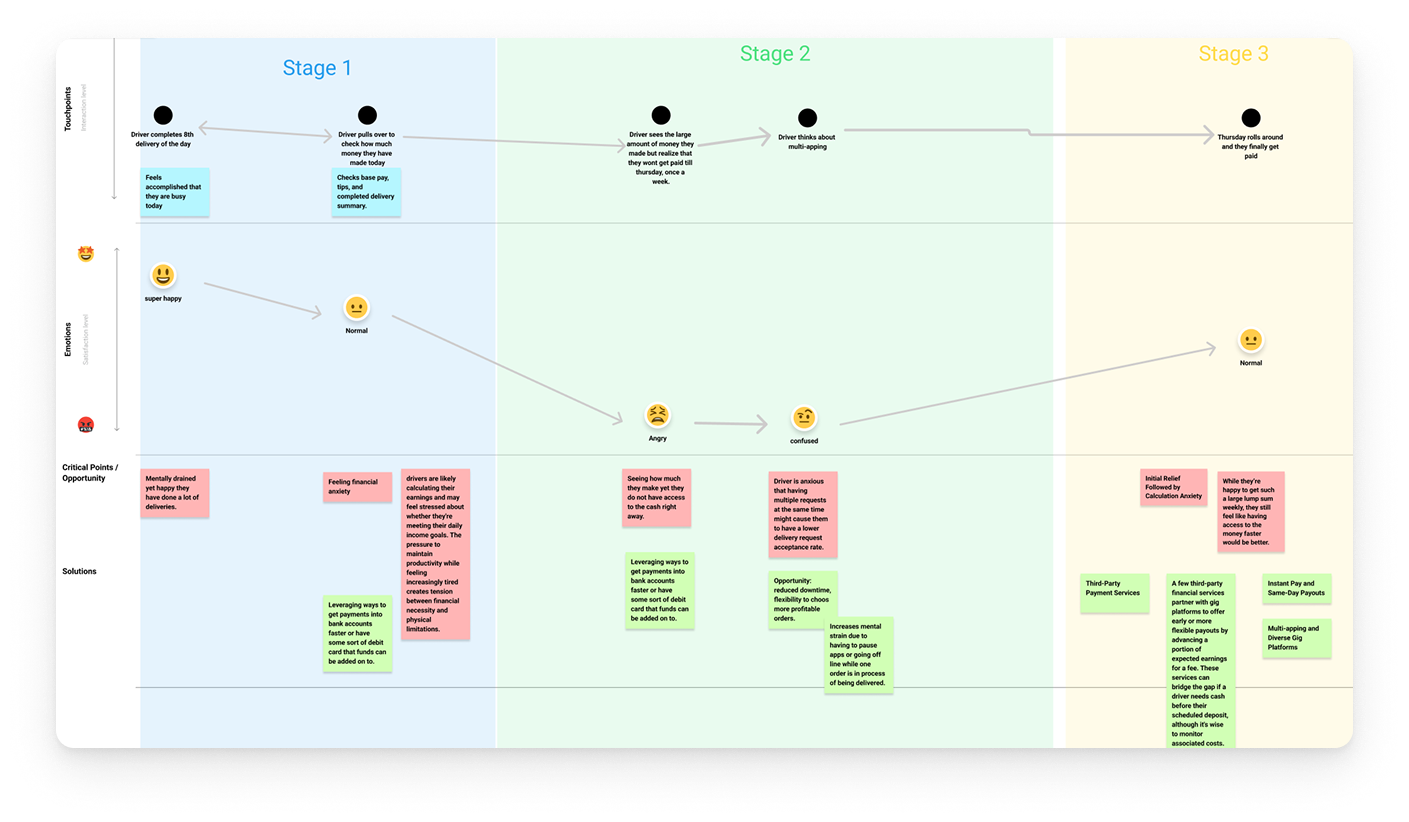

Met with Grubhub teams to capture driver insights, which enabled me to map the end-to-end driver payment journey.

What I learned

Through qualitative research, I confirmed that delivery driving serves as either a primary or secondary income source for participants, revealing that financial anxiety and the need for faster payments were common concerns, which led to prioritizing quicker earnings access for multi-platform gig workers.

Eyebrow text to label this content

Who are we delivering to?

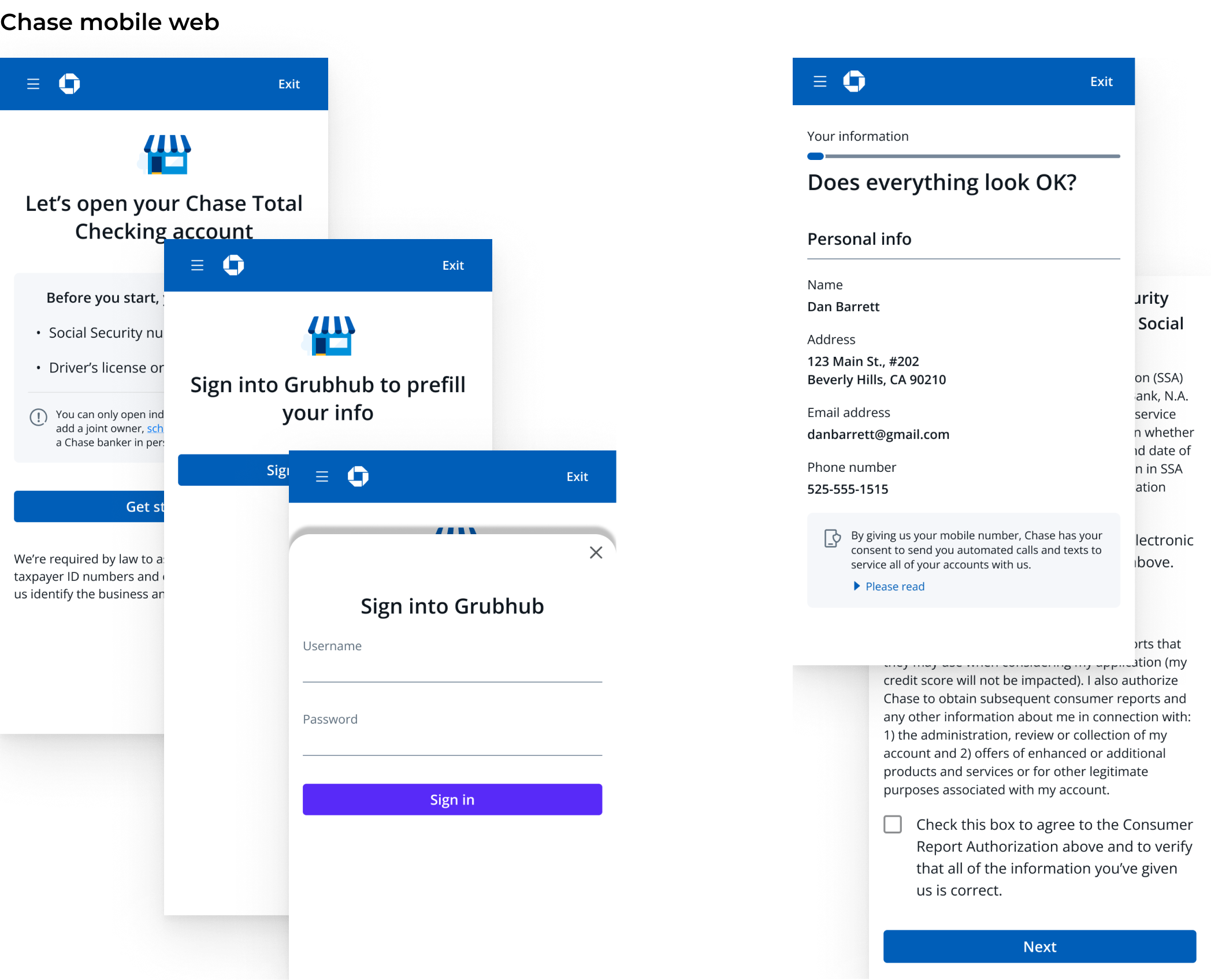

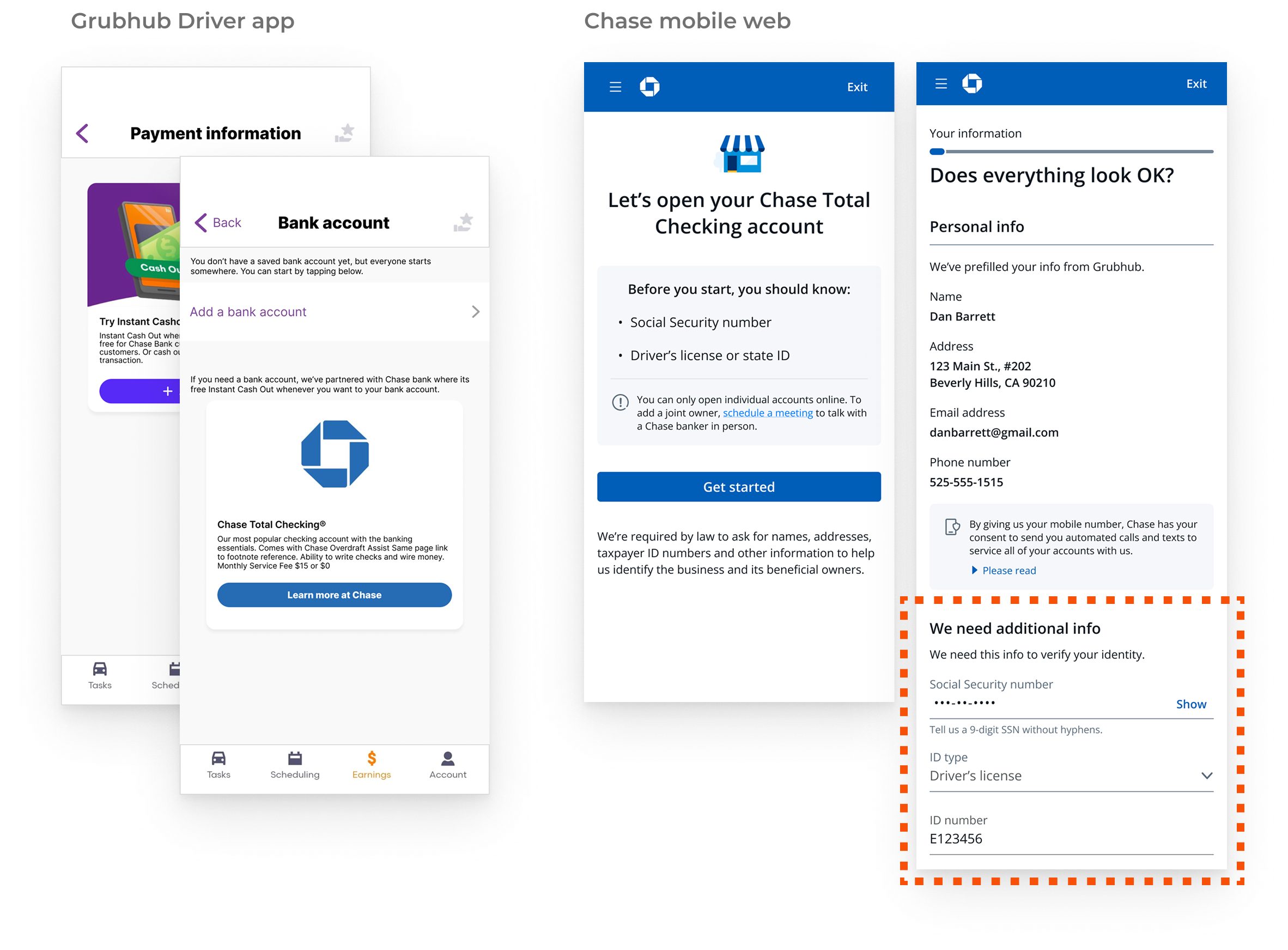

Early designs focused on a mobile web experience and using Grubhub’s sign in info.

Our demographic included Grubhub drivers who were new and existing Chase customers.

For drivers who didnt bank with Chase, I aimed to simplify the onboarding process by utilizing existing data collected by Grubhub.

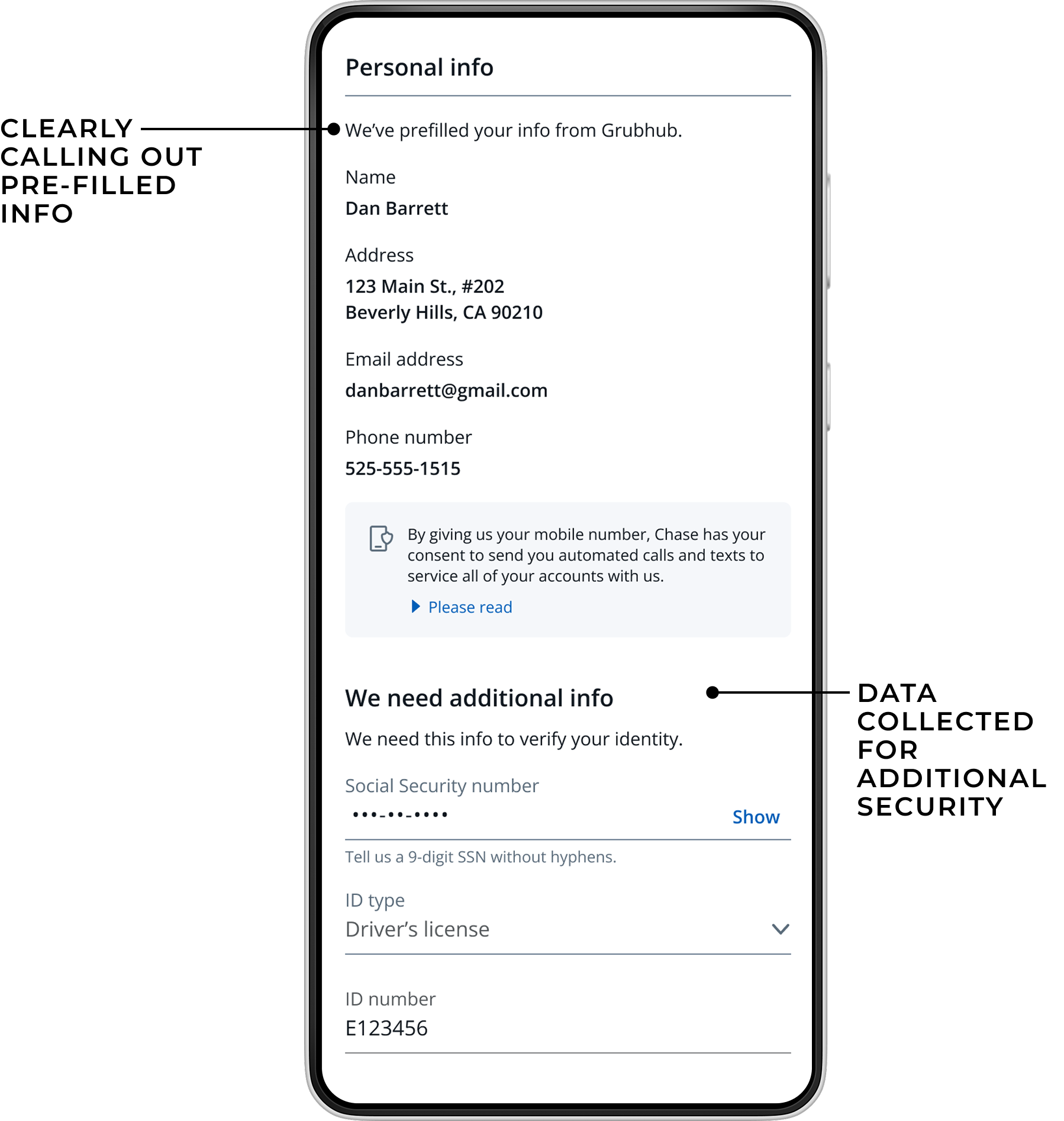

Construction zone, navigating regulatory complexity

Chase legal and compliance wanted the option of extra verification steps, including re-scanning IDs and re-entering personal information.

This was a “just in case” if there were any red flags during account submission.

Solution: progressive onboarding

We see you, we explain why

I faced a critical tension: Legal required full identity verification, but our research showed high friction killed conversion.

- The Pivot: I proposed a 'trust-but-verify' model utilizing the Grubhub API. We pre-validated users based on their employment data, allowing us to defer the heavy ID scanning only to edge cases with data discrepancies.

- The Win: This satisfied Compliance's risk requirements while keeping the 'happy path' friction-free for 60% of users."

Eyebrow text to label this content

How its going

Time for a spare tire

- Taking the added constraint from legal and compliance, I partnered with our cross-functional team to build an API integrating Grubhub’s data with Chase’s systems.

- This integration streamlined the experience while maintaining regulatory compliance.

Fast cash, happy drivers

- Over 60% of Grubhub drivers adopted Instant Cash Out as their primary or supplemental way to access earnings, using it an average of three times per week to receive funds within minutes per delivery.

- The collaboration boosted driver satisfaction, increased financial flexibility, and delivered measurable user and business benefits at scale.

Eyebrow text to label this content

Key Takeaways

Collaborative Approach

Success was built on close partnerships with both internal teams (product, engineering, compliance) and external partners (Grubhub). This cross-functional collaboration ensured alignment between technical feasibility, regulatory requirements, and user needs.

Strategic Incentives Drive Adoption

Offering free instant cash-out for Chase customers (while charging a nominal fee for others) proved effective. This approach leveraged existing customer relationships while still creating value for new users and the business.

44% increase in JPMorgan’s real-time payments network volume within months

API-First Advocacy

I championed the API-first data model early in discovery. By demonstrating prototypes of the 'zero-entry' onboarding flow to product and engineering, I helped secure the backend resources needed to build the Chase-Grubhub data bridge, proving that technical investment directly drives user acquisition.

Next case study

Instant Payments

Solving Cash Flow Challenges for Gig Workers with Instant Payment Solutions

MY ROLE

Lead product designer

TEAM

1 Lead product designer

1 Content designer

1 UX researcher

1 Product manager

1 SWE team

TIMELINE

September 2018 - January 2019

Problem

Gig workers, including food delivery drivers, traditionally faced significant cash flow challenges due to weekly payment cycles. This model often left them struggling to meet immediate financial needs.

Product Vision

I saw an opportunity to transform Chase from a passive utility into an active partner for the gig economy. By integrating directly with Grubhub's data, we could eliminate the 'application fatigue' that caused 40% of applicants to drop off, turning a compliance-heavy banking process into a bite sized benefit.

Solution

With the rise of innovative payment solutions, there was an opportunity to transform how these workers access their earnings, ensuring they receive payments instantly when needed.

Eyebrow text to label this content

My Responsibilities

In this Chase - Grubhub partnership, my objective was to collaborate with the Grubhub team to accelerate payment processes for their drivers.

Met with Grubhub teams to capture driver insights, which enabled me to map the end-to-end driver payment journey.

What I learned

Through qualitative research, I confirmed that delivery driving serves as either a primary or secondary income source for participants, revealing that financial anxiety and the need for faster payments were common concerns, which led to prioritizing quicker earnings access for multi-platform gig workers.

Eyebrow text to label this content

Who are we delivering to?

Early designs focused on a mobile web experience and using Grubhub’s sign in info.

Our demographic included Grubhub drivers who were new and existing Chase customers.

For drivers who didnt bank with Chase, I aimed to simplify the onboarding process by utilizing existing data collected by Grubhub.

Construction zone, navigating regulatory complexity

Chase legal and compliance wanted the option of extra verification steps, including re-scanning IDs and re-entering personal information.

This was a “just in case” if there were any red flags during account submission.

Eyebrow text to label this content

Solution: progressive onboarding

We see you, we explain why

I faced a critical tension: Legal required full identity verification, but our research showed high friction killed conversion.

- The Pivot: I proposed a 'trust-but-verify' model utilizing the Grubhub API. We pre-validated users based on their employment data, allowing us to defer the heavy ID scanning only to edge cases with data discrepancies.

- The Win: This satisfied Compliance's risk requirements while keeping the 'happy path' friction-free for 60% of users."

Eyebrow text to label this content

How its going

Time for a spare tire

- Taking the added constraint from legal and compliance, I partnered with our cross-functional team to build an API integrating Grubhub’s data with Chase’s systems.

- This integration streamlined the experience while maintaining regulatory compliance.

Fast cash, happy drivers

- Over 60% of Grubhub drivers adopted Instant Cash Out as their primary or supplemental way to access earnings, using it an average of three times per week to receive funds within minutes per delivery.

- The collaboration boosted driver satisfaction, increased financial flexibility, and delivered measurable user and business benefits at scale.

Eyebrow text to label this content

Key Takeaways

Collaborative Approach

Success was built on close partnerships with both internal teams (product, engineering, compliance) and external partners (Grubhub). This cross-functional collaboration ensured alignment between technical feasibility, regulatory requirements, and user needs.

Strategic Incentives Drive Adoption

Offering free instant cash-out for Chase customers (while charging a nominal fee for others) proved effective. This approach leveraged existing customer relationships while still creating value for new users and the business.

44% increase in JPMorgan’s real-time payments network volume within months

API-First Advocacy

I championed the API-first data model early in discovery. By demonstrating prototypes of the 'zero-entry' onboarding flow to product and engineering, I helped secure the backend resources needed to build the Chase-Grubhub data bridge, proving that technical investment directly drives user acquisition.

Next case study

Instant Payments

Solving Cash Flow Challenges for Gig Workers with Instant Payment Solutions

MY ROLE

Lead product designer

TIMELINE

September 2018 - January 2019

TEAM

1 Lead product designer

1 Content designer

1 UX researcher

1 Product manager

1 SWE team

Problem

Gig workers, including food delivery drivers, traditionally faced significant cash flow challenges due to weekly payment cycles. This model often left them struggling to meet immediate financial needs.

Product Vision

I saw an opportunity to transform Chase from a passive utility into an active partner for the gig economy. By integrating directly with Grubhub's data, we could eliminate the 'application fatigue' that caused 40% of applicants to drop off, turning a compliance-heavy banking process into a bite sized benefit.

Opportunity

With the rise of innovative payment solutions, there was an opportunity to transform how these workers access their earnings, ensuring they receive payments instantly when needed.

Eyebrow text to label this content

My Responsibilities

In this Chase - Grubhub partnership, my objective was to collaborate with the Grubhub team to accelerate payment processes for their drivers.

Met with Grubhub teams to capture driver insights, which enabled me to map the end-to-end driver payment journey.

What I learned

Through qualitative research, I confirmed that delivery driving serves as either a primary or secondary income source for participants, revealing that financial anxiety and the need for faster payments were common concerns, which led to prioritizing quicker earnings access for multi-platform gig workers.

Eyebrow text to label this content

Who are we delivering to?

Early designs focused on a mobile web experience and using Grubhub’s sign in info.

Our demographic included Grubhub drivers who were new and existing Chase customers.

For drivers who didnt bank with Chase, I aimed to simplify the onboarding process by utilizing existing data collected by Grubhub.

Construction zone, navigating regulatory complexity

Chase legal and compliance wanted the option of extra verification steps, including re-scanning IDs and re-entering personal information.

This was a “just in case” if there were any red flags during account submission.

Eyebrow text to label this content

Solution: progressive onboarding

We see you, we explain why

I faced a critical tension: Legal required full identity verification, but our research showed high friction killed conversion.

- The Pivot: I proposed a 'trust-but-verify' model utilizing the Grubhub API. We pre-validated users based on their employment data, allowing us to defer the heavy ID scanning only to edge cases with data discrepancies.

- The Win: This satisfied Compliance's risk requirements while keeping the 'happy path' friction-free for 60% of users."

Eyebrow text to label this content

How its going

Time for a spare tire

- Taking the added constraint from legal and compliance, I partnered with our cross-functional team to build an API integrating Grubhub’s data with Chase’s systems.

- This integration streamlined the experience while maintaining regulatory compliance.

Fast cash, happy drivers

- Over 60% of Grubhub drivers adopted Instant Cash Out as their primary or supplemental way to access earnings, using it an average of three times per week to receive funds within minutes per delivery.

- The collaboration boosted driver satisfaction, increased financial flexibility, and delivered measurable user and business benefits at scale.

Eyebrow text to label this content

Key Takeaways

Collaborative Approach

Success was built on close partnerships with both internal teams (product, engineering, compliance) and external partners (Grubhub). This cross-functional collaboration ensured alignment between technical feasibility, regulatory requirements, and user needs.

Strategic Incentives Drive Adoption

Offering free instant cash-out for Chase customers (while charging a nominal fee for others) proved effective. This approach leveraged existing customer relationships while still creating value for new users and the business.

44% increase in JPMorgan’s real-time payments network volume within months

API-First Advocacy

I championed the API-first data model early in discovery. By demonstrating prototypes of the 'zero-entry' onboarding flow to product and engineering, I helped secure the backend resources needed to build the Chase-Grubhub data bridge, proving that technical investment directly drives user acquisition.

Next case study